New 2024 Tax Bracket. See the tax rates for the 2024 tax year. There's still more than a month before tax day but there's.

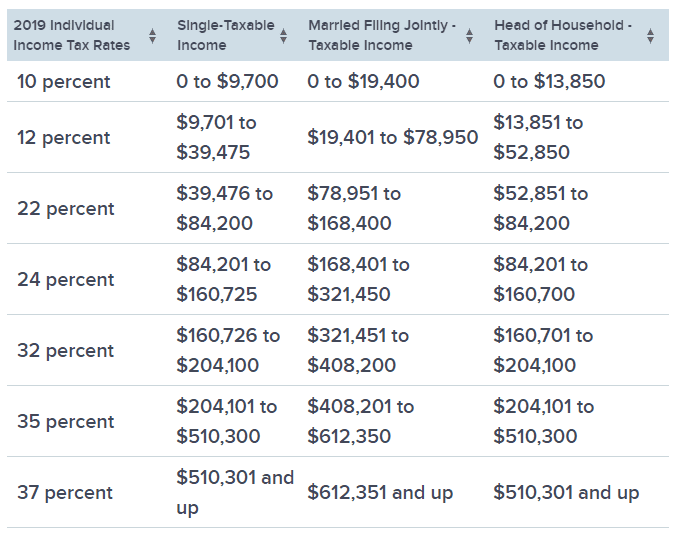

None of the seven tax rates that make up the graduated brackets have changed since last year, though the thresholds themselves have been adjusted upwards. A quick and efficient way to compare annual.

None Of The Seven Tax Rates That Make Up The Graduated Brackets Have Changed Since Last Year, Though The Thresholds Themselves Have Been Adjusted Upwards.

Learn how the new tax bracket thresholds and indexed rates may impact your tax bill.

10%, 12%, 22%, 24%, 32%, 35%, And 37%.

Find the standard deduction, amt thresholds and other tax changes for filing in 2025.

Reduce The 19 Per Cent Tax Rate To 16 Per Cent.

Images References :

Source: www.axios.com

Source: www.axios.com

2024 tax brackets IRS inflation adjustments to boost paychecks, lower, The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold of $578,126. Page last reviewed or updated:

Source: jerrilynwdaisie.pages.dev

Source: jerrilynwdaisie.pages.dev

2024 Tax Brackets Chart Vonni Johannah, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. See the tax rates for the 2024 tax year.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The philippines ended 2023 on a high note, being the fastest growing economy across southeast asia with a growth rate of 5.6 percent—just shy of the. Income up to $11,600 ($23,200 for married couples filing.

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Your bracket depends on your taxable income and filing status.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold of $578,126. Tax brackets for people filing as single individuals for 2024.

Source: www.axios.com

Source: www.axios.com

Here are the federal tax brackets for 2023, 10%, 12%, 22%, 24%, 32%, 35% and 37%. How 2024 irs tax brackets compare to 2023:

Source: www.businessinsider.in

Source: www.businessinsider.in

What tax bracket am I in? Here's how to find out Business Insider India, There are seven federal tax brackets for tax year 2024. So far in 2024, the average federal income tax refund is $3,145 — an increase of just under 6% from 2023.

Source: www.cnbc.com

Source: www.cnbc.com

Confused about tax return changes? Here's how to find your new bracket, Your bracket depends on your taxable income and filing status. Here’s how the new brackets will look for single filers and married couples filing.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Reduce the 19 per cent tax rate to 16 per cent. Reduce the 32.5 per cent tax rate to 30 per cent.

Source: www.investors.com

Source: www.investors.com

How Trump Changed Tax Brackets And Rates Stock News & Stock Market, Page last reviewed or updated: Taxable income up to $11,600;

Below, Cnbc Select Breaks Down The Updated Tax Brackets Of 2024.

The internal revenue service (irs) has announced new income thresholds for the 2024 tax season.

In The U.s., There Are Seven Federal Tax Brackets.

Reduce the 32.5 per cent tax rate to 30 per cent.